Beyond Bitcoin: Learning from the Internet Era

When investors think about crypto, the discussion usually starts with Bitcoin. As the first digital asset, it established the blockchain's potential and remains the benchmark of the asset class. Yet, just as the internet rapidly grew beyond its early pioneers, crypto has expanded far beyond Bitcoin.

New networks are being built to process transactions faster, support digital payments, and enable applications that can run without traditional intermediaries. Together, these innovations represent the “infrastructure phase” of crypto — laying the groundwork for broader use cases in finance, commerce, and technology. Bitcoin opened the door, but the opportunity now extends across a wide spectrum of possibilities.

As with any emerging industry, this creates both risk and potential reward. While Bitcoin remains the most established asset, many of the newer segments of the mar- ket carry the possibility of outsized returns. This is especially true in light of the significant structural developments that have taken place regarding regulatory acceptance and institutional adoption. While some projects may never gain traction, others could become the foundational platforms of tomorrow’s economy — in some cases we believe they could deliver even greater growth potential than Bitcoin itself. The challenge is that no one can reliably predict which players will succeed. For investors, the upside may be significant, but so is the uncertainty — making a diversified approach essential.

History underscores this reality. In 1999, investors faced the same challenge with internet equities: the technology was clearly transformative, but leadership was uncertain. Of the ten largest companies in the Nasdaq 100 at the time, only Microsoft remains in the top tier today. This pattern extends beyond tech. Broad indices like the Dow Jones Industrial Average, that tracks the performance of 30 of the largest publicly traded companies in the U.S., and the S&P 500 Index, that represents the performance of 500 of the largest publicly traded companies in the U.S., show constant rotation: industrial leaders such as General Electric and Exxon once dominated, but today Apple, Tesla, and Nvidia sit at the top. The Fortune 500 Index highlights the same dynamic, with the average lifespan of a company on the list falling to less than 20 years, compared to over 60 years in the 1960s.

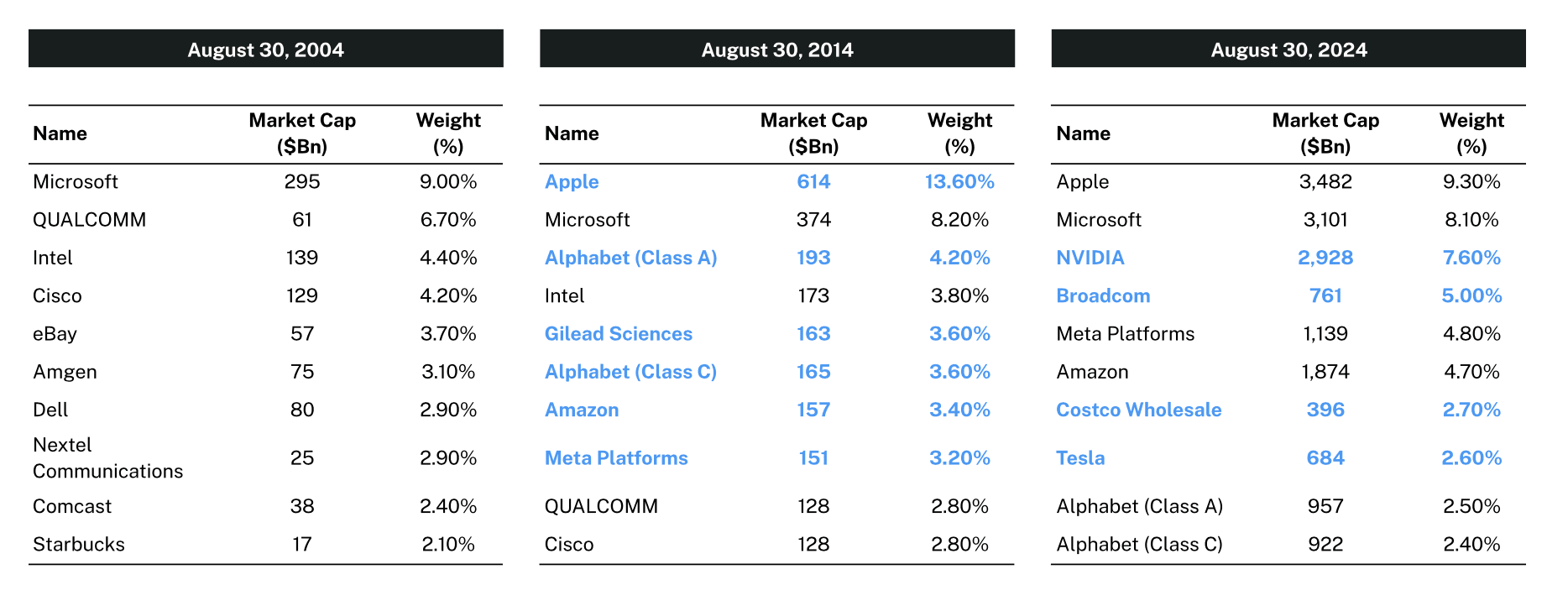

Figure 1: The Technology Uncertainty

This table illustrates the change in market leadership between 2004 and 2024, underscoring the difficulty of long-term stock picking in technology sectors.